Legislative Update - Jan. 31, 2023

Kansas needs a better budgeting approach.

It was disappointing to hear that Gov. Kelly's proposed budget prioritizes new government spending -- to the tune of more than $2 billion! Even though Kansas will have a SURPLUS of $2-$3 BILLION in this fiscal year, the governor's budget grabs that surplus and spends it on new programs, rather than returning it to you and your neighbor taxpayers.

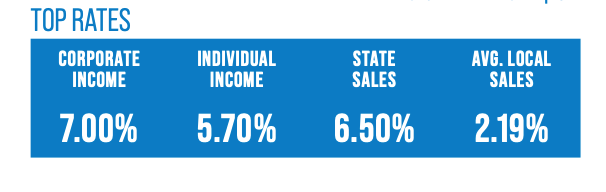

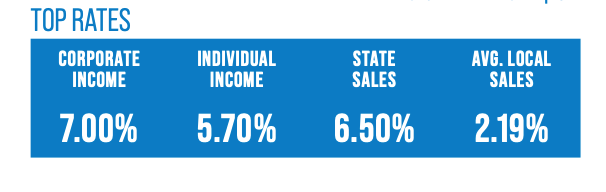

The state is clearly taxing you more than it needs to operate an efficient government. I favor income tax reductions, which would help reduce the size and scope of government and help make Kansas competitive again. We have lost residents -- our taxpayer base -- due to high personal and business income taxes (see rates below) that ranks Kansas worst in the nation in taxation in categories like taxes on mature businesses (those businesses that have built our communities, employed thousands and supported our communities).

I am working with my colleagues in the House to examine ways to return your income to you while maintaining state services and programs. We have more than $2 billion reasons to do so.

The state is clearly taxing you more than it needs to operate an efficient government. I favor income tax reductions, which would help reduce the size and scope of government and help make Kansas competitive again. We have lost residents -- our taxpayer base -- due to high personal and business income taxes (see rates below) that ranks Kansas worst in the nation in taxation in categories like taxes on mature businesses (those businesses that have built our communities, employed thousands and supported our communities).

I am working with my colleagues in the House to examine ways to return your income to you while maintaining state services and programs. We have more than $2 billion reasons to do so.

|

|

Property Tax Relief for Seniors

During my re-election campaign, I supported prioritizing tax relief for seniors in District 39 and throughout the state. We are already working on this. One change is a first step in a property tax freeze for low income seniors and disabled veterans via a rebate program administered by the KS Department of Revenue (KDOR). Learn more here.

Don't miss these legislative updates! Get them as they're published!